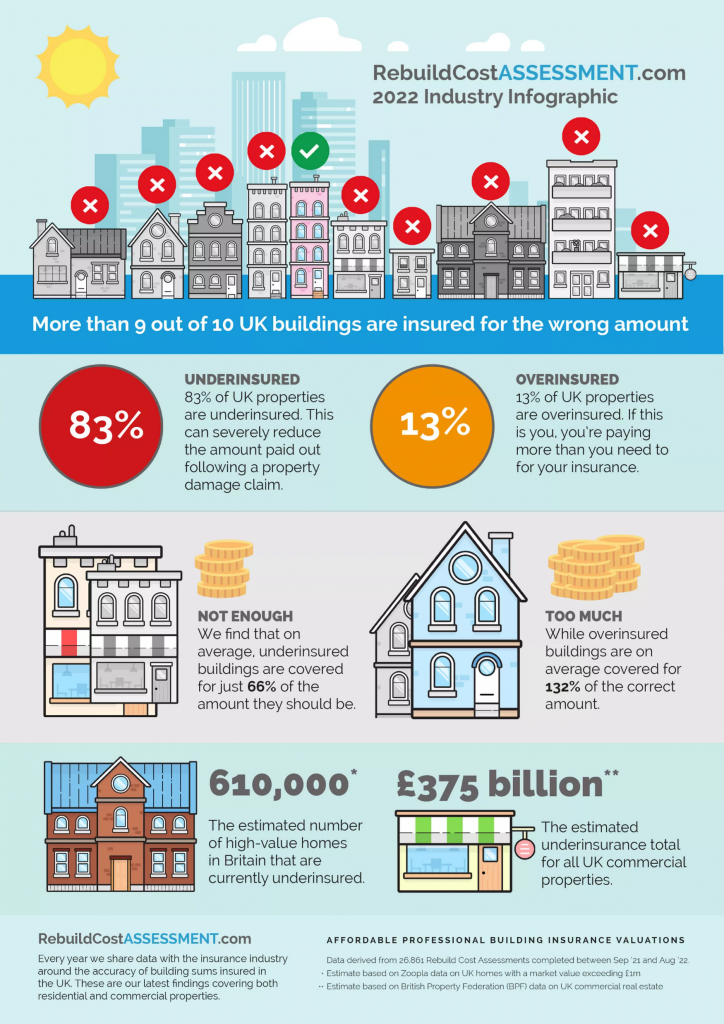

The estimated underinsurance total for UK commercial properties is £375 billion*

Posted by Sell My Group in Park Industry News, March 21, 2023

Rightsize Your Insurance with Towergate Insurance

What does “Rightsize Your Insurance” mean?

Rightsize Your Insurance is not just about looking for areas where you may be exposed through underinsurance or a gap in your cover protection. It’s about reviewing all your park insurances against your needs and advising you accordingly. Your insurance could be perfectly suitable, but with an estimated 96% of UK business premises incorrectly insured* (based on 26,861 businesses surveyed) your park may be missing essential covers or you may be paying for something you don’t need.

Towergate Insurance will help and advise you based on the requirements for your site.

Why is it important that you Rightsize Your Insurance?

There are many factors that affect whether a business has the right levels of cover in place or not. Inflation and supply chain challenges are just some of the current things at play – individually they can have a huge impact but, combined are a perfect storm.

Covers and limits set even just 12 months ago may now be out of date, leaving businesses potentially exposed and vulnerable should they need to make a claim.

What is the ‘average clause’, and why do I need to know about it?

Insurance policies have clauses and conditions that come with the cover. When the ‘average clause’ is applied to an insurance policy, in the event of underinsurance, the claim paid out by the insurer is reduced to the same proportion as the value of the underinsurance. Essentially, if you haven’t paid the correct premium for the value of your property, the claim paid will be reduced. In the worst-case scenario, some insurers may not pay anything out in claims at all if the underinsurance is significant.

For example, a clubhouse with current rebuild value of £1M, has Buildings Sums Insured of £800K (80% of the actual current value). Following storm damage, a claim for £10K is made. Applying the average clause, the amount paid out will only be 80% (£8K) of the claim.

With so much change in material costs, coupled with recent inflation keeping your insurance requirements under regular review is more important than ever. Renewing your park insurance based on market indexing could leave you under insured and in turn affect your financial resilience in the event of a claim.

For a free no obligation quote, call Towergate Insurance on 0344 892 1721, email commercialtradingchelt@towergate.co.uk or visit www.towergateinsurance.co.uk

*Data derived from 26,861 Rebuild Cost Assessments completed between Sep 21 and Aug 22.

Sell My Park Home Ltd is an Introducer of Towergate Insurance. Towergate Insurance is a trading name of Advisory Insurance Brokers Limited. Registered in England with company number 4043759. VAT Registration Number: 447284724. Registered Address: 2 Minster Court, Mincing Lane, London EC3R 7PD. Authorised and regulated by the Financial Conduct Authority. This can be checked on the FCAs register by checking the FCA website at www.fca.org.uk/register or by contacting them on 0800 111 6768.